Some Economic highlights and commentary for Canadians to illustrate some harsh realities looking forward for Millennials especially as the next apex generation coming into power inheriting a huge role. These are highlights the government doesn’t talk about to continue to either hold economic control over the people or they are just that ignorant to their own involvement over the economic output of our country. There is no real discussion occurring and those to be heavily burdened are the current youth and Millennials of the future economic landscape of this country.

Net Federal Debt = $1.2 Trillion

Deficit for 2020-21 rises to $343.2 billion from $34.4 billion projected before pandemic.

Federal debt-to-GDP ratio is expected to rise to 49% in 2020-21 from 31%

With low Interests, debt of Canadians will continue to rise, adding more liabilities to the Canadian economy’s books.

We have a probable outlook of aggressive inflation as a consequence of the ignorant economic manipulation of government intervention, with all this giving of money and no analysis on the long term trade offs . Their actions are driving costs up squeezing citizens (hard working people) margins. With less capital left over to keep for themselves and to build/strengthen their own personal balance sheets. The people of the economy is the baseline for a strong economy.

Why is the government weakening its citizens and thus the economy?

Why do they keep seeking enhanced control with clearly a history of inability?

There is always unforeseen economic consequences that the people as a collective must burden, while government continues to use lack of capital as reasoning for further control in the environment to promise short term solutions. Those elected by the majority, making significant decisions with always unforeseen consequences driven by the endless amount of self interest minority groups. Its a broken cycle with endless economic consequences.

Millennials are consumers, not producers. This is a very important distinction to understand the future power of our dollar as an economy. The purchasing power of a country.

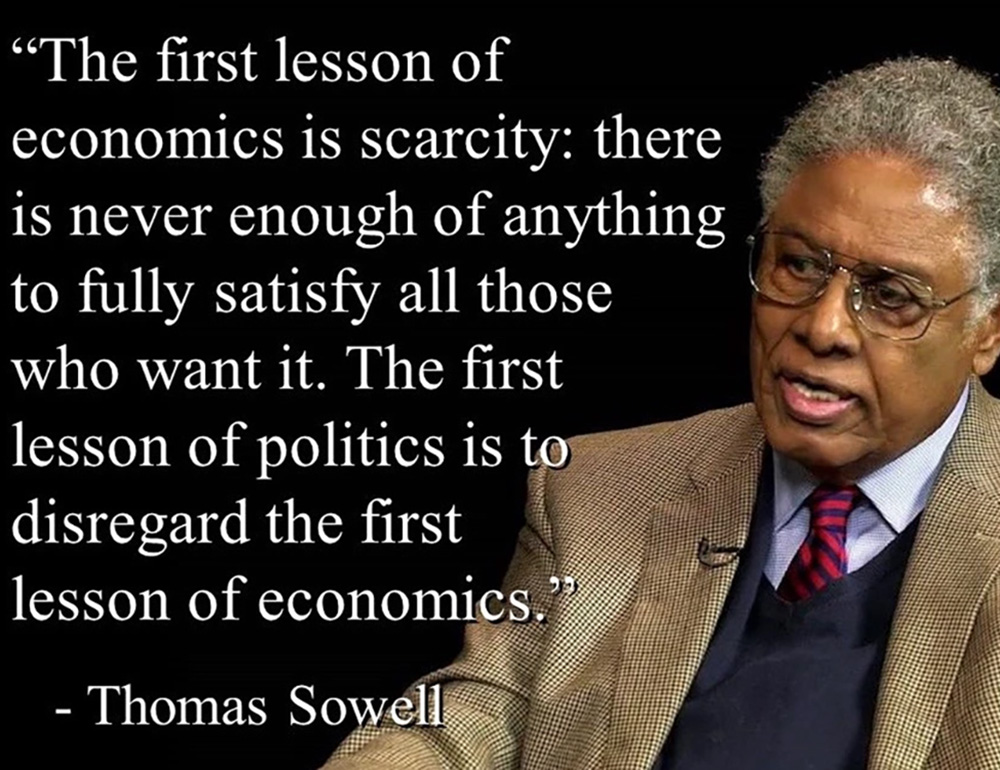

Most political decisions are at the mercy of the future economy to provide a short term smokescreen without talking about the consequences. It is a game of politics for votes. A high school popularity contest, about what they can promise and evade in the short term. Good politics is bad economics as the great Peter Schiff states. Clearly, this is observable. Just need to do a snapshot of the 2020 economy and backtest it. All the dynamics light up and you can observe the broken pattern occurring yielding us to this current economic reality.

Wages aren’t increasing meanwhile cost of living is going up and so is the amount of taxes we pay as a consequence. Many of the unnecessary regulations and policies implemented on the many by endless minority groups keeps adding costs to our system, therefore more revenues needed by the state. Taxes are also an issue when abused. What produces workers is the business market, that requires people to pursue ways to add value to the market by solving problems, producing value to the economy. When government implements higher business taxes, those with very good business margins can easily adapt and continue to thrive. But now when you look at businesses with high operational cost, they tend to have smaller margins. Especially when people try to create ventures and business start ups, they need every $ to try and grow to become a viable business that can compete and sustainability add value to the economy. So once you establish that those at the starting line and with heavier costs on their shoulders suffer the most from these taxes, you have to ask yourself, who’s truly winning with these added taxes that only makes it harder for those at the bottom to climb the mountain.

There appears to be a perpetual cycle of pressure on those at the bottom of the economic ladder, one driven by many political economic policies and decisions.

If businesses pay more in taxes and costs, they can’t give back more to their employees because they also need to worry about cashflow in order to survive long term. You cannot expect a business to survive through hard times with tiny margins.

This trickles down to the workers who keep paying more with costs going up, so without more income growth (if small and medium businesses who employ the most in an economy have less money, well then so will most of its employees). With stagnated income (since businesses at the middle and at the bottom can’t grow, neither does employment income), and increasing costs from government manipulation, the citizen’s margins get destroyed. Each citizen must be seen as a business, with personal financials as their analytical tool.

More money keeps going from citizens to government with nothing but economic problems spiraling out of control. And no results to validate their continued increase in tax collections, except by adding more promises to problems they often time cause through their own policies. The states economic power has only increased over time (more money keeps flowing to them), and with their obsession over control, they are suppressing incredible human capability to pursue incredible ways to add good to a collective in their own way. Suppressing the economic landscape is suppressing entrepreneurial spirit. A strong, growing and fair economy requires that ability to be accountable and take risks. Our humanity alone shows the incredible power of our problem solving capabilities. Lets find a way to remove the lid off those capabilities, that human drive.

Health care is out of control (weak and costly)

—-> In 2019, total health expenditure in Canada was expected to reach $264 billion, or $ 7,068 per person. It is anticipated that, overall, health spending represented 11.6% of Canada’s gross domestic product (GDP).

https://www.cihi.ca/en/health-spending

– seriously question how does our money get spent and where. I say where because you cannot even go audit their financials and costs related to our health care or any other major Government industries they control. Its fairy dust, lol. Its sad and funny at the same time.

Education is out of control (weak and costly)

> Canada’s school boards spent a total of $53.2 billion — about $11,300 per student — educating students in kindergarten to Grade 12 public systems in 2015 and that amount has been growing by more than $1 billion every year for several years.

2018-2019 Tax revenues at the Federal Level were $332.2 Billion

> with covid, this number will dip, at least I’m assuming with loss jobs, and recession.

https://www.canada.ca/en/department-finance/services/publications/annual-financial-report/2019/report.html

Real estate is facing a huge bubble, with the way prices are inflating and now with low interests pushing more to buy without taking into account future interests being higher to offset this low period. Balance is key in economics and thus the argument for higher interests later on is hard to dispute. With no economic growth, no growth in wages, more taxes being paid out, and continued weakness of individual citizen balance sheets, there is a huge bubble building with no fundamental support to the disaster broiling. In technical finance, you always see when gaps get created, and gaps must be closed. This economic bubble will have to collapse for us to cycle into a more effective economic expansion.

I could keep writing endlessly highlighting issues. It’s insane and scary.

We need to get our shit together as the collective people. If the majority of people can understand the Economic game put forth in front of them, as a whole this economy would be much healthier, stronger and charitable to those in need.

Nicholas Tartaglia