As an investor, accounting for all variables (positive and negative) with objectivity is the most effective means of ensuring effective decisions, To buy or not to buy. To sell of not to sell. With so many risks facing this relatively new asset class, being alert and ready for anything is crucial. This is the best way to minimize our downside risk by openly analyzing the risk factors facing Bitcoin, As these risks expand or regress, we can either go more aggressive into a bitcoin position or secure profit before it turns.

Be objective and read with purpose, put aside any bias and be critical.

Too much irrational psychology is driving this insane price action.

This does not take away the fact that bitcoin can very much continue to see increase price action, but it clearly has many risks not being accounted for and discussed. Being an investor is about knowing the risks and discussing them to keep them on our radar to not be blind sided if the asset price reverses. Adversity for this speculative asset still exists.

1) The psychology

If we look at the psychological component of bitcoin and how it’s being driven/portrayed, bitcoin has been piggy backing on the principles and appearance of Gold, unable to stand its own ground with its own identity. I’m trying to compare bitcoin to gold in terms of psychological penetration for value perspective. For bitcoin to claim TO BE digital gold, it has to pass and survive through different economic cycles and markets, as well as attain mass cultural and economic adoption. Until it passes through its tests and cycles to further validate its existence and thesis, it is a speculative ride. More like fools gold until it proves itself to weather all these risks. Once that occurs, then it can emulate the value of gold as being its digital equivalent. It is not there yet, objectively speaking, that cannot be denied. This is a matter of objective analysis, not driven by any desire for a specific price action.

Look also at how it shows itself online as having the appearance of a gold coin. That is validation of the bitcoin ecosystem trying to make bitcoin appear like something it has factually not yet established. It makes bitcoin look like a marketing game more than anything else. Trying to benefit from the physical appearance of Gold, even though it has no physical form, a little conflicting.

Why can’t bitcoin have its own identify?

Why does it have to use the subconscious value of gold for it to be validated?

It should find strength on its own. Is that not reasonable of the expectation for an emerging new asset?

Bitcoin is thriving off perceived value, not true value. Bitcoin needs internet connection, implying a dependency on technology and natural resources to allow Bitcoin to exist and be held on devices and so on. There seems to be a human desire to always deviate from natural reality, which in my observations always yields undesirable outcomes.

There is also a huge psychological flaw I am seeing growing, where people are using the adoption of companies allowing bitcoin as a means of payment on their platform as a value booster for bitcoin. The flaw in this is that it would require people to use it as a currency to actually pay for things/buy from companies for this to validate its value. People aren’t using it for that, therefore these actions of allowing bitcoin doesn’t add value unless it were for that purpose. So if we simply analyze the way bitcoin users engage with it, we then see it more as an asset, not a form of payment. That diminishes the fundamental value proposal of companies allowing it as a form of payment, since no one is going to use it for that, at least not currently since people are hoping to make it rich instead.

2) Political Risk/Centralized planning

Socialism by nature requires centralized planning, which means control over the market to ensure it controls how it sees best to allocate resources, hence centralized. This applies to also having control over the economy which is where the market (the people) have the greatest power to control the collective outcome through collaboration with their accepted means of exchange. If 2020 and still into 2021 has taught hopefully anything enlightening to many, is the clear observation of the amount of control and power over the people and their dynamics the government has. That is centralized planning within the market place, as businesses, workers and consumers should typically produce the desirable dynamics/outcomes, and not the central planner.

Now that we’ve established this centralized reality of our ecosystem, that risk is also expected with bitcoin or crypto. As they behave with a state knows best and centralized planning framework, they desire to control the pieces on their board, the premise of military framework. That is why they still utilize Keynesian economics to fuel this new modern day theory type of economic philosophy in the central banks and government. This requires them to control the variables in the short term to produce short term monetary confidence; look at their fixation on the utilization of GDP and unemployment as their favorable metrics. Using the printing press, they can subsidize employee salaries of businesses not even operating or give new money supply through welfare, EI, CERB, unemployment. They can create the appearance of strong GDP in the short term by printing, and giving money to people to spend. But this doesn’t produce productive expenditure, which is the only true way of expanding the economy efficiently and sustainably.

Having said that, knowing they behave this way all over the world, how can we so naively assume they wont find a way to squeeze their political and regulatory grips all over Bitcoin? How do we know they wont push it back into the dark web, like China is doing to implement its own digital coin?

If USA does one of their own, they don’t want to have competition. Plus there’s a significant possibility that a significant percentage of all bitcoins are owned by a small group of individuals validated by the ledger. That puts the confidence of the markets currency in the hands of unknowns who can easily impact massive volatile swings in the price. That isn’t good if we want it as a currency. Again, from a central planning POV, doesn’t seem logical to allow this to dominate or thrive the way they want it to. Governments will do whatever it needs to do, to minimize risks within their plans, especially with the geo-political and social-economic issues occurring globally, and growing. With how much debt and fragility that exists in the global economies, they need to be very careful with how they let the market bring unpredictability to attaining their desirable and “controllable” outcome.

Governments can say it doesn’t accept it as tax payment. It can also prevent banks from allowing it to be processed or stored with insured protection like regulated fiats. This means the default fiat or form of money will be what it can control and regulate. That is until the very framework changes, which simply the people adopting bitcoin doesn’t change that centralized planning reality. This framework currently empowering political power over the market place exists in all 3 major continental economies; North America, Europe, Asia. That is a huge uphill challenge that may not produce the outcome we think, in the face of political and monetary forces. The banking system works on loans, and it is regulated by the government, so yet again another place where most of the money supply comes into the market comes in as regulated fiat. Investing, paying taxes, having a bank account, getting loans; all places of exchange that requires the accepted regulated fiat.

Free market having economic power means no political power, therefore no centralized framework. It’s 2021, and all of the world’s major governments are deepening and demonstrating their power over the market, clear as day. So this is a massive risk because to control the outcome especially when it’s all about votes in the midst of all sorts of chaos (politically, economically, socially), you can’t possibly assume a positive development. There is too much unpredictability, that is asking for more chaos in a already massively chaotic present reality. There is no supporting action to validate that it will certainly turn out as the bitcoin holders desire. We are more likely to see governments try and control the crypto ecosystem, to ensure they minimize their risks, after all they do it with everything else. Therefore it would seem as though it’s naïve to assume otherwise, after witnessing 2020 and the start of 2021. I don’t know why those who talk about bitcoin being decentralized as such a beautiful value to it when the system is more likely to want to control it, then not, that is centralizing it into a political framework. Doesn’t seem very outside the system if it depends so heavily on the system to grow its market cap.

Extra Sources

– “Digital Gold” and Geopolitics: Bitcoin as a Political Risk Haven (forbes.com)

– Effects of the Geopolitical Risks on Bitcoin Returns and Volatility | Request PDF (researchgate.net)

– This Is Who Controls Bitcoin (forbes.com)

– Bitcoin’s Network Operations Are Controlled by Five Companies – Bloomberg

– Regulation of Cryptocurrency Around the World (loc.gov)

– Is Bitcoin the Answer in a Financial Crisis? (thebalance.com)

2) Monetary point of view/ Currency or asset?

From a monetary and economic POV, to allow an asset (since it is being held like an asset not a currency) to be utilized in the ecosystem as a primary currency, is just confusing when trying to observe the intent in relation to what is actually being done with bitcoin. We need to ensure that what we implement is reliable and dependable, or else we are attempting yet again another experiment, which is what the government did when it went off the gold standard and now look at the economic disaster we are in. Human ego and greed allowed to deviate the collective from natural and sustainable progression, seems to cause so much social economic chaos.

Also, as a form of currency, it would be equivalent to a fiat since it is not backed either. Another conflicting argument that is made about it. The hedge against fiats is also a fiat, the only difference is that it is a digital fiat. This is why I believe in bitcoin if it is backed within a monetary framework that makes sense, because things that are not backed in the modern age of monetary theories, are at almost certain risk of greed and/or human ignorance to be abused. Being backed helps to alleviate those psychological risks. How the collective operates should be founded on principles of reality to ensure sustainability, a logical desire to minimize consequences on the collective.

So that is another monetary argument often used that doesn’t appear to make much sense to me. It is as thought human desire for price action to make money has taken the purpose of bitcoin on a different route than its original intent. Remember also, for an ecosystem to utilize a standard form of exchange, there needs to be predictability in the price of bitcoin, and it cannot be volatile like it currently is. How do we create a proper system of exchange with something like bitcoin that changes price by multitudes of % on a daily basis? Doesn’t seem very logical. The economy cannot exchange goods and services with that volatility. It also has a slow transaction capability which fuels the risk of what happens if there is a better improved version Bitcoin 2.0 that solves that problem? Mass exodus to 2.0?

It needs to be stable as a means of value for it to be utilized as desired.

Why isn’t the focus on how to actually implement it and make it a relevant currency that can be utilized? Shouldn’t we focus more on the actual utility of it rather than the price action? Greed appears to be driving this more than anything else.

Forking bitcoin into new branches can easily be done and centralized, basically replicating the dilution of money supply. So even if bitcoin itself is finite to 21 million, the crypto ecosystem can expand and fork in countless possible ways. So, theoretically, that finite component can be circumvented, by constantly forking bitcoin into new forms, which would only devalue bitcoin itself. The entire crypto space is at heavy risk of this possibility since there are limitless possible new coins that can be created. And would be insane to back a digital fiat by another fiat. That’s absolutely redundant. This does not solve the fiat issue.

When you look at social media, the very community also mocks and laughs at those who use and or used bitcoin as a means of exchange (like its supposed purpose) for payment. Isn’t that the whole purpose of it? Yet they create a sense of don’t ever sell just hold, well then when will anyone actually use it as a currency when using it as a currency seems wrong within the crypto community. Seems more like greed for price action than about the beauty of its utility. That also expands the negative gap within the fundamental framework of bitcoin. People want it to be an asset while arguing monetary purposes. Its conflicting logic and only brings more unknown to the outcome of this asset. And I call it an asset because people treat it that way.

Is bitcoin and what it is currently versus its original purpose a risk we are yet again willing to take? If you say yes, is that an objective stance or a desire?

Does it make sense for the collective when we already have so many problems?

Extra Sources

– (PDF) Bitcoin – Asset or currency? Revealing users’ hidden intentions (researchgate.net)

– Bitcoin Is An Asset, Not A Currency (forbes.com)

– BitcoinAsset?.pptx (nyu.edu)

3) Storage of Value (SoV) Proposal

For this section we will utilize references directly from Bitcoin.com to highlight the very plausible argument for this value proposal:

“Over the last few years, many have claimed that bitcoin core (BTC) has turned into, or will soon become, a store of value (SoV). Proponents of the BTC-based SoV theory seem to think that money can somehow store value and if it’s held long enough, the price will be higher or predictably useful when spent at a later date. This is an economic fallacy however because money cannot store value and, as innovative as bitcoin is, it will never be immune to market influences.

There are a ton of people who believe that BTC is a store of value and that if they keep hodling someday they might be super wealthy and protected from the world’s turbulent economy. Except this couldn’t be further from the truth. BTC is not an SoV currently, and never will be due to the fact that money itself cannot be an SoV. The idea that money cannot serve as a store of value has been written about by many economists over the years including Carl Menger, Murray Rothbard, and Ludwig von Mises. Carl Menger (1840-1921) was the founder of the Austrian school of economics proper. Menger was one of the first economists to explain in detail about the relationship of value and money to market prices. Menger writes in Principles of Economics: Value is … nothing inherent in goods, no property of them, but merely the importance that we first attribute to the satisfaction of our needs … and in consequence carry over to economic goods as the … causes of the satisfaction of our needs.”

– https://news.bitcoin.com/putting-an-end-to-the-bitcoin-store-of-value-fallacy/

4) Sustainability Risk

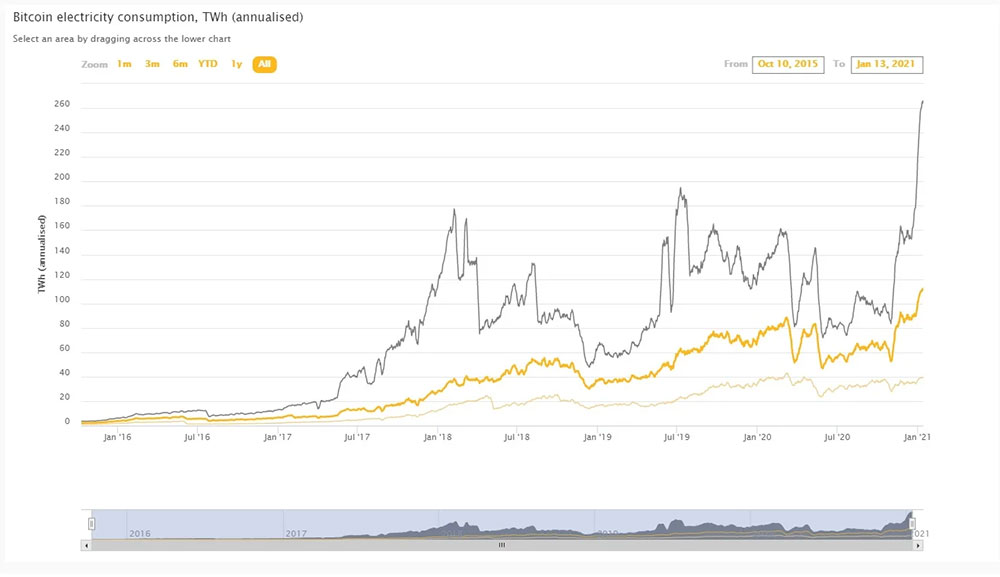

“Currently, the tool estimates that Bitcoin is using around seven gigawatts of electricity, equal to 0.21% of the world’s supply. That is as much power as would be generated by seven Dungeness nuclear power plants at once. Over the course of a year, this equates to roughly the same power consumption as Switzerland.”

“Mr de Vries said that Bitcoin still appears to use far more energy per transaction than all the world’s banks put together, when considering the amount of energy used by data centres. The electricity used for Bitcoin produces about 22 megatons of CO2 annually, a study in the scientific journal Joule estimated. That is as much as Kansas City in the US.”

– Bitcoin’s energy consumption ‘equals that of Switzerland’ – BBC News

Published 3 July 2019

Cambridge Bitcoin Electricity Consumption Index

– https://cbeci.org/

– https://digiconomist.net/bitcoin-energy-consumption

As of Jan 14, 2021

Theoretical lower bound: 4.86 GW – 39.39 TWh

Estimated 13.73 GW – Annualised consumption 111.27TWh

Theoretical upper bound: 32.58 GW – 263.97TWh

“Bitcoin may be a useful way to send and receive money, but cryptocurrency isn’t created for free. The community of computer-based miners that create bitcoins uses vast quantities of electrical power in the process. The electricity-heavy process has led some experts to suggest that bitcoin isn’t an environmentally friendly endeavor.

So how much electricity does a bitcoin take to produce? Written testimony presented to the U.S. Senate Committee on Energy and Natural Resources in August 2018 claims that bitcoin mining accounts for about 1% of the world’s energy consumption.”

“If this information is correct, the bitcoin network in 2020 consumes 120 gigawatts (GW) per second. This converts to about 63 terawatt-hours (TWh) per year.

This staggering amount of power is the equivalent of 156 million horses (1.3 million horses per GW) or 49,440 wind turbines (412 turbines per GW) generating power at peak production per second.”

– How Much Power Does It Take to Create a Bitcoin? (thebalance.com)

Sustainability is becoming more and more an important variable in human actions in order to ensure we are more balanced with our natural world. It is something humans have neglected for a long time, having disconnected from nature and their relationship to the natural world. If it is an important factor in our development forward, then we need to look at bitcoin from a sustainability POV to ensure it falls within acceptable parameters of our desired intent. Greed and desire for wealth cannot deviate the objectivity of our desired outcome as a collective.

We can argue for sure, let’s create a renewable source of energy to produce what is needed for the bitcoin ecosystem, which only demands more energy as it expands and becomes harder for bitcoins to come into existence. The flaw I can see in this is that, how much land are we willing to permanently use up in order to ensure this ecosystem exists indefinitely? Because if the ecosystem needs energy indefinitely for it to exist, then we are not allowing the land to replenish. When compared to gold for example, once the gold is mined and extracted, no extra energy is needed to keep it into existence. Gold has a one time cost, and once the land is done being mined, we can nourish the soil and seek to give it back to the planet to heal and replenish new minerals and life for the future of the planet. Our actions need to be aligned with the timeline of humanity beyond the years we are in existence. Beyond our own existence. To be sustainable, one must think linear into the future beyond the parameters of one’s personal life span. Greed thrives at the personal level which makes one ignore time beyond their lifespan.

Does bitcoin pass this test of sustainability? To answer this, the price of bitcoin and personal desire for wealth from it has to be put aside, and objectivity to the purpose of this question must be given.

Extra Sources

– Bitcoin Mining Energy Usage: The Good, the Bad and the Future (coincentral.com)

– Bitcoin Energy Consumption Index – Digiconomist

– (PDF) Energy Consumption of Bitcoin Mining (researchgate.net)

– Cryptocurrency Energy Consumption | Energy Institute (umich.edu)

5) Time & Depression Resistance

This risk breaks down into 3 factors that don’t appear to be accounted for.

1 – Will bitcoin survive time?

An 11 year story is not very much evidence that it can pass the test of time. For context, its rival Gold for example has 6000 years of history and purpose. It has been at the side of human civilization expansion, so we know it is reliable, it has history to validate this, alongside universal acceptance,

2 – Will it survive the transition of wealth between generations?

Because the psychology of generations is heavily impacting the adoption of bitcoin and other cryptos, what says that very psychological adoption is also not a risk that could cause a future generation to say they rather their own version of a crypto they feel more connected to and believe is not owned by the older generations, since the clash between youth and old seems to be an old tale. Since this asset or currency, whatever you wish to call it for now, is so easily driven and influenced by perceived value. That can easily change. Its current baseline is one based on pure psychology; greed and fomo.

3 – Will bitcoin survive a plausible depression occurring in North America and all over the world?

This is also a very important risk not being mentioned. In a depression, people struggle financially and debt also becomes a significant issue. The question becomes, does bitcoin survive in a depression environment which is not a macro environment it has yet to experience. If it collapses in that environment, then it holds as a risk asset correlated to the debt expansion of the ecosystem. If it could hold true and strong through that environment, especially with the potential deflationary environment, then this could be a significant fundamental boost. To be determined soon enough.

6) Hacking & Theft

I myself am not a tech wizard, and this specific risk is very real. It posses a risk to the adoption of bitcoin. This could drive people to only wanting exposure to bitcoin within financial products created by institutions, which solidifies it further as an asset and less so as something that could be used as a currency, which is the original thesis and value proposal. Also, makes the coin more and more centralized in the very system that it seeks to be outside of.

- Stealing the private keys to gain access to a wallet.

– “Blockchain, the Bitcoin public ledger, maintains a record of all the addresses and a certain value is then attached to the particular key that identifies each record. So, when someone owns Bitcoin, what they actually have is the private key for unlocking a particular address on the Blockchain. These keys are stored both online and offline in so many different ways and each of them has a certain security level. Nevertheless, they all are vulnerable because, as you want to know how to hack a Bitcoin wallet, all you have to do is to somehow access that character’s string which forms the private key.” - Keyloggers:

– “It’s the malware that records the keystrokes of the users and sends it all to the hacker. It is almost impossible to detect these programs and you might even have it running on your smartphone or computer right now without noticing it at all. They copy every seed, password and pin that you type and can turn out to be an effective answer to the question of how to hack a Bitcoin faucet. They can really provide hackers an easy gateway to all the bitcoins they want to hack.” - Fake wallets:

– “Another cool option you have to answer how to hack Bitcoin wallets, this one gives you a more sophisticated way of achieving your goal. It also needs you to do some work on your part as these fake wallets are simply the apps which resemble genuine wallets but are meant to steal the Bitcoins away. These apps typically use official logos and everything else of existing Bitcoin wallets for tricking the users and stealing the Bitcoins away. These fake wallets are a routine thing both on Apple and Android App Stores.” - Bitcoin miner malware.

– “Today, Bitcoin is simply mined through the biggest Bitcoin malware botnets. Though they don’t have any negative intentions, still the use of a computer this way is not authorized as they tend to hijack the online video equipment and the victim bears all the cost. As a result, the hijacked computers are also slowed down as well.” - Transfer Trojans

– “Another option available to those looking to find out how to hack a Bitcoin address is to transfer Trojans and simply get Bitcoins transferred to their personal wallets. The cryptocurrency Trojans are meant to monitor computers and wait for anything that looks like a crypto account number. And, as soon as they spot one, they take action and replace the user’s intended account from that of the hacker and as soon as the user hits that ‘Send’ button, all the funds are transferred to the account of the hacker. Again, there’s no recovering from this either.”

6) Innovation

The very innovative nature of technology is a threat to the continuity of bitcoin, for it is primitive in the face of technological advancement. With it being 11 years old only, it could find a new and improved bitcoin version in a decade that steals all the attention away, since its value is based on to the incredible tech that is blockchain, which is innovative by nature. Therefore innovation itself is a risk to this primitive digital coin. Well then logically speaking, if we maintain that thesis, we should seek to allocate the capital to the new and improved version, not simply hold it for sentimental purpose. That is a threat moving forward.

Based on tech in a world where human are obsessed with innovating tech (diminishes the utility value purpose of the original bitcoin), therefore, the very nature of what makes bitcoin so incredible is also what could make it obsolete. That’s a significant risk.

@nictartaglia

come discuss this with me

come challenge these risks with me